BANG! Why Is Bank Reconciliation Statement Necessary

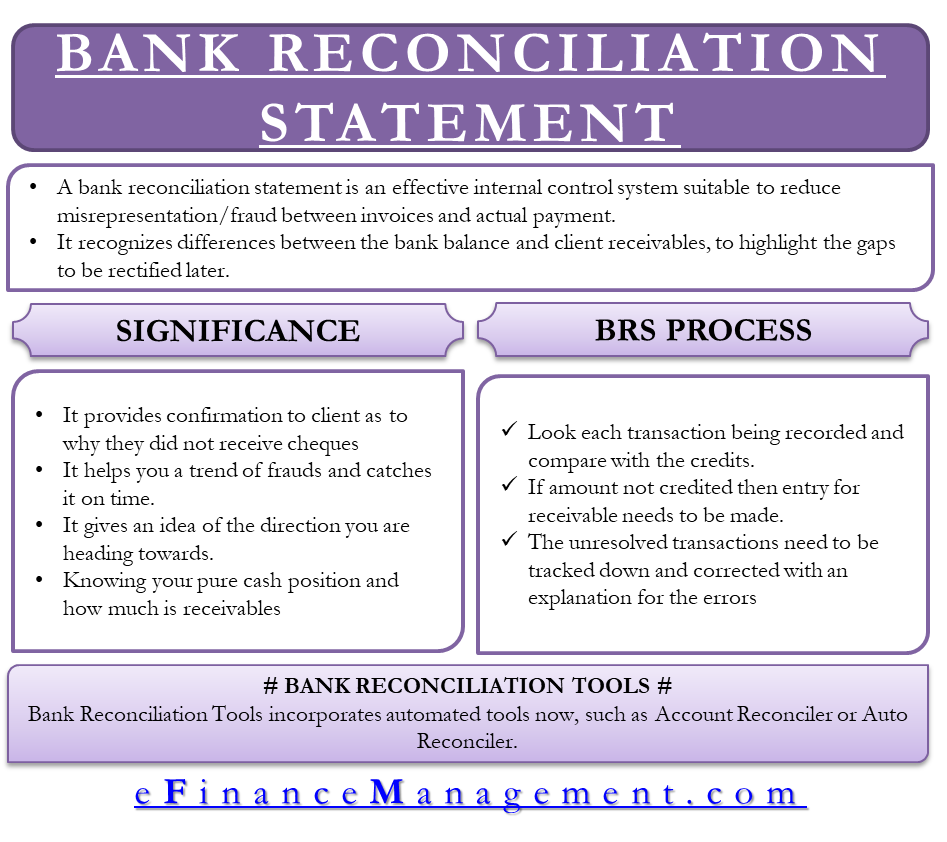

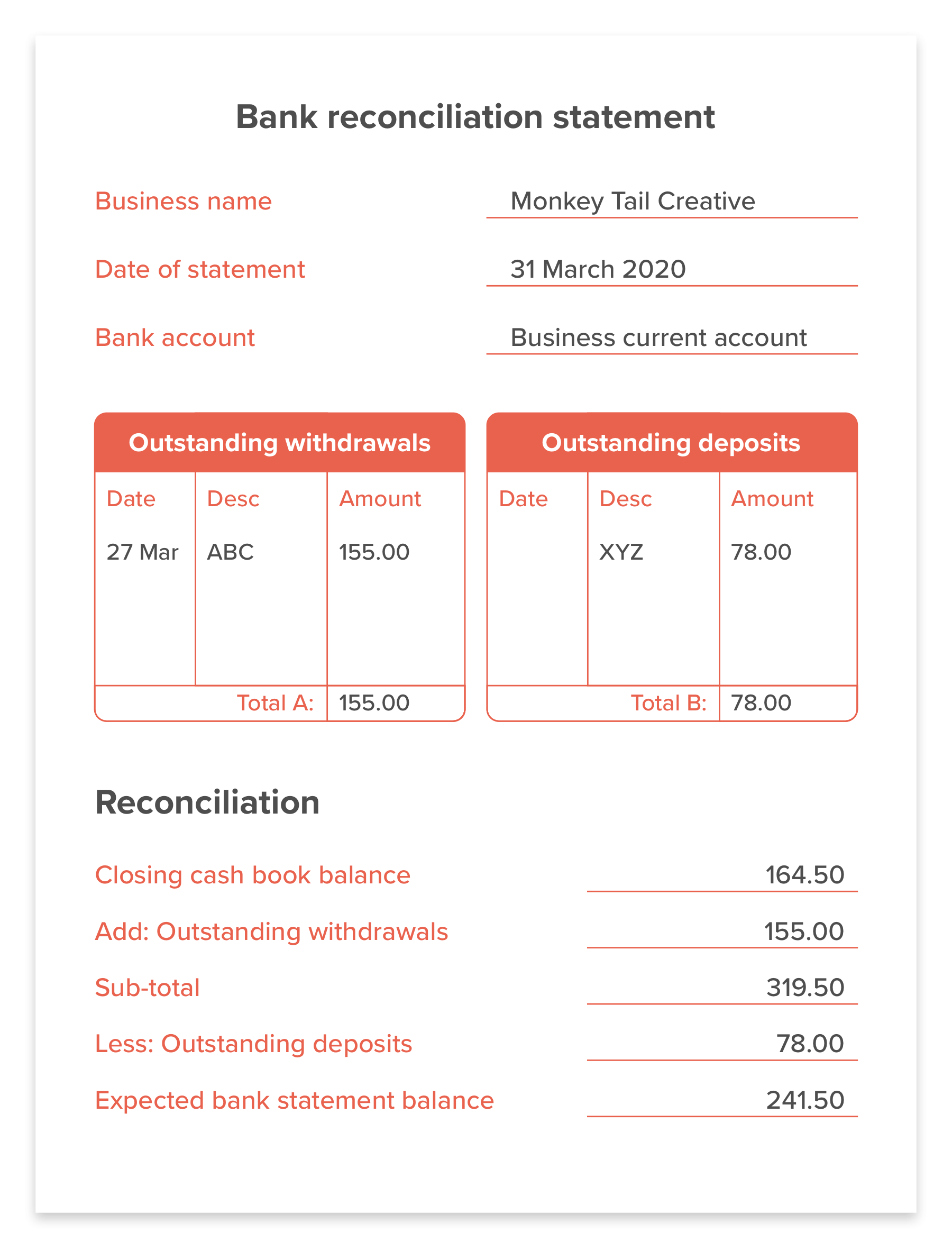

This statement helps the account holders to check and keep track of their funds and update the transaction record that they have made. A bank reconciliation is used to compare your records to those of your bank to see if there are any differences between these two sets of records for your cash transactionsThe ending balance of your version of the cash records is known as the book balance while the banks version is called the bank balanceIt is extremely common for there to be differences between the two balances which.

Bank Reconciliation Statement Definition Explanation Example And Causes Of Difference Accounting For Management

Bank reconciliations provide the necessary control mechanism to help protect the valuable resource through uncovering irregularities such as unauthorized bank withdrawals.

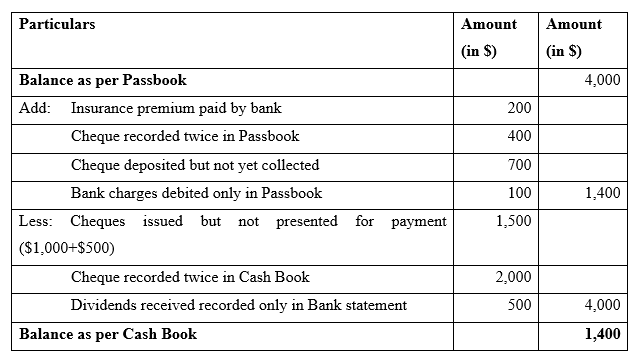

Why is bank reconciliation statement necessary. Bank reconciliation is incredibly important for a number of reasons. To create a reconciliation statement companies need to compare their internal bank records with the bank passbook. World Leader in Accounts Receivable Automation Serves 200 Fortune 1000 companies SMEs.

Your business and the bank keep separate records of deposits withdrawals checks and every other cash balance that flows in and out of the business. Why a bank reconciliation necessary. To safeguard the companys cash.

If you have bank accounts it is very important that you perform bank reconciliation at least once every month. Bank Reconciliation statement is also known as bank passbook. Unless the bank statements are completed correctly the financial statement would be far more reliable and effective.

A bank reconciliation statement is necessary for the correct management of a companys cash and records. Why is bank reconciliation necessary. The bank reconciliation ensures.

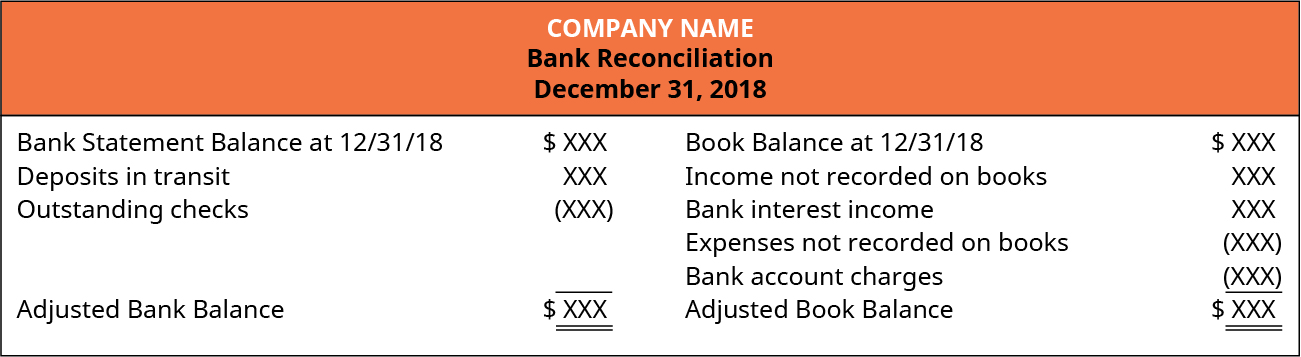

The result is that any transactions in the accounting records not found on the bank statement. Bank Reconciliation - Why Bank Reconciliation is Important Bank reconciliation is the procedure of comparing and matching figures from the accounting records against those shown on a bank statement. It might not be necessary to make a reconciliation statement if your bank and internal bank statement show the same balance but if the same balance isnt shown then the reason behind the same need to be located soon.

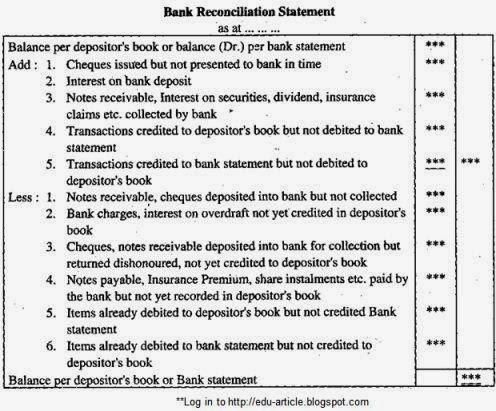

All transactions between depositor and the bank are entered separately by both the parties in their records. It is a must for every business owner. The first is preventing mistakes such as receipts recorded incorrectly payments that werent entered and other events that could impact on your monthly finances.

Bank reconciliations verify the integrity of data between the bank records and a companys internal financial records. Reasons for Preparing a Bank Reconciliation. The reconciliation statement helps identify differences between the bank balance and book balance in order to process necessary adjustments or corrections.

Among other reasons enlisted below are some of the most important reasons why it is important to prepare a bank reconciliation statement. Bank reconciliation is an essential part of the internal controls of a business mainly in terms of recognizing recording mistakes and fraud. By optimizing bill payments with a bank reconciliation statement companies may improve their efficiency and delivery.

There are two primary ones that come to mind. Preparation of bank reconciliation statement is not optional. Why must you perform bank reconciliation.

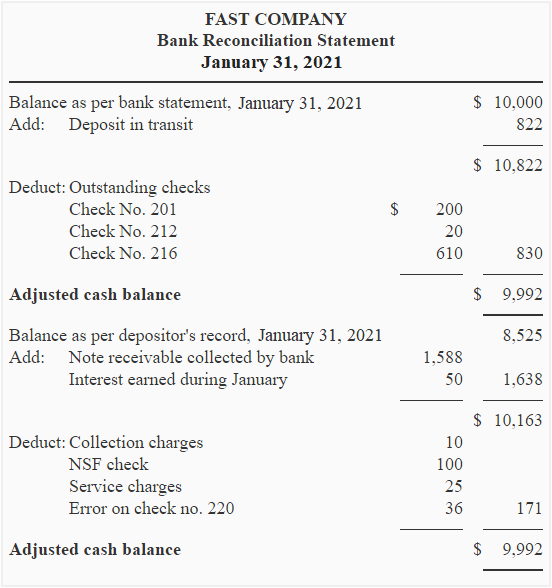

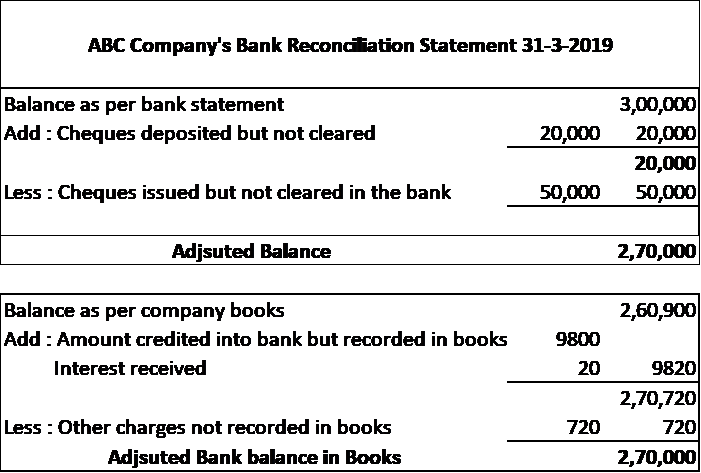

For small businesses the main goal of reconciling your bank statement is to ensure that. Bank statement contains an ending balance of 300000 on February 28 2018 whereas the companys ledger shows an ending balance of 260900. Preparation of bank reconciliation helps in the identification of errors in the accounting records of the company or the bank.

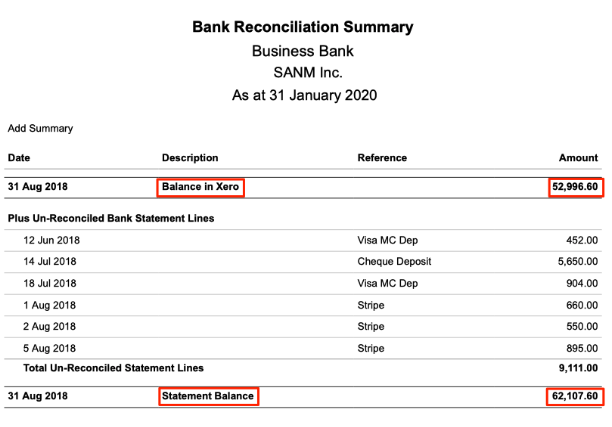

Bank reconciliations are an essential internal control tool and are necessary in preventing and detecting fraud. Preparation of bank reconciliation helps in the identification of errors in the accounting records of the company or the bank. Bank Reconciliation Statement The term bank reconciliation actually refers to the process of verifying and adjusting cash movement whereas a bank reconciliation statement is the formal document that a business prepares to maintain for its own records.

Bank Reconciliation Statement Meaning. Bank reconciliations provide the necessary control mechanism to help protect the valuable resource through uncovering irregularities such as unauthorized bank withdrawals. Cash is the most vulnerable asset of an entity.

Performing a bank reconciliation results in improved internal control over the companys cash if the reconciliation is done by someone other than the person handling andor recording receipts. Accuracy Each month the passbook of the bank and the cash book of a firm display a particular amount which is the balance in the bank as on that date. The very nature of a reconciliation control is detective.

XYZ Company is closing its books and must prepare a bank reconciliation for the following items. A bank reconciliation is used to compare your records to those of your bank to see if there are any diffe. Bank reconciliation is an essential part of the internal controls of a business mainly in terms of recognizing recording mistakes and fraud.

The second is uncovering fraud. There are several reasons for a company to prepare a bank reconciliation. Bank statement contains a 100 service charge for operating the account.

Bank reconciliation is a very important task for any company. Ad AI RPA Powered Bank Allocation Software For 99 Automation of GL Postings. They also help identify accounting and bank errors by providing explanations of the differences between the accounting records cash balances and the bank balance position per the bank statement.

Bank Reconciliation Statement is a record book of the transactions of a bank account. A Bank Reconciliation Statement is prepared periodically to reconcile the two balances and. A bank reconciliation is a schedule that explains any discrepancies between the balance on the bank statement and the balance on your businesss financial records.

A bank reconciliation is a key control for many companies when on an ongoing basis accounting teams take necessary steps to substantiate cash on the balance sheet. The bank reconciliation procedure offers an independent verification of the accurateness of the accounting records of the business and must be completed before. Cash is the most vulnerable asset of an entity.

Bank reconciliation statement is a statement that depositors prepare to find explain and understand any differences between the balance in bank statement and the balance in their accounting records.

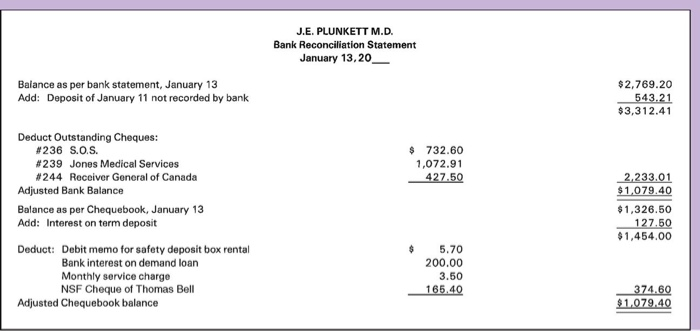

Sample Of A Company S Bank Reconciliation With Amounts Accountingcoach

Sample Of A Company S Bank Reconciliation With Amounts Accountingcoach

Bank Reconciliation Services Simple Accounting

Bank Reconciliation Statement Brs Bank Account

What Is Bank Reconciliation Brs How To Prepare It

Bank Reconciliation Statement Definition Daily Business

Why Do A Bank Reconciliation 5 Reasons To Reconcile Monthly

Bank Reconciliation Statement Check Balancing Reconciliation

The Importance Of Bank Reconciliations Connectcpa

Define The Purpose Of A Bank Reconciliation And Prepare A Bank Reconciliation And Its Associated Journal Entries Principles Of Accounting Volume 1 Financial Accounting

What Is Bank Reconciliation And Do I Really Need To Do It

Bank Reconciliation Statement Definition Types Template

Example Of Bank Reconciliation Statement Pdfsimpli

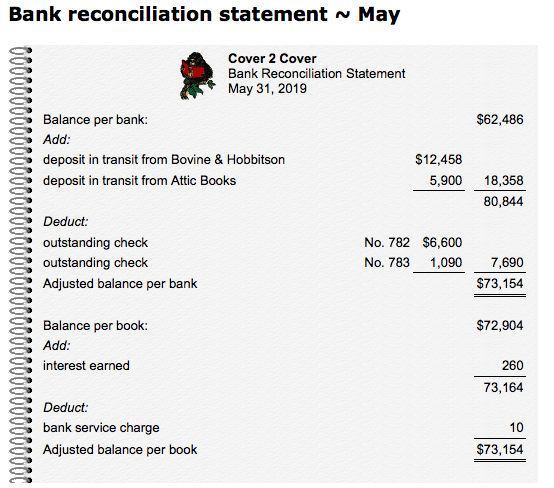

Solved Prepare A Bank Reconciliation Statement For Chegg Com

Bank Reconciliation Statement Brs Format And Steps To Prepare

Solved Instructions For Bank Reconciliation 1 Prepare The Chegg Com

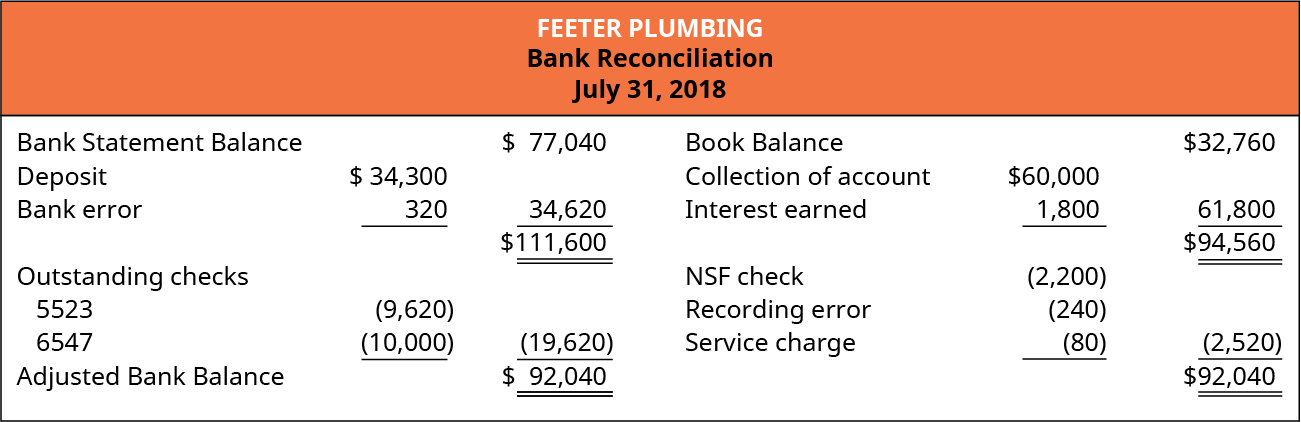

Preparing A Bank Reconciliation Statement Method Format Steps And Rules Solved Example

Define The Purpose Of A Bank Reconciliation And Prepare A Bank Reconciliation And Its Associated Journal Entries Principles Of Accounting Volume 1 Financial Accounting

Bank Reconciliation Statement Whats Included And How Its Used For Cash Balance Reconciliation Accounting Basics Accounting And Finance

Comments

Post a Comment